The motivation for this three-part blog series occurred when we noticed a sizeable percentage of respondents gave one answer about their perceived home internet service tier (“basic,” “moderate” or “premium”) but a very different response about their perceived download speeds (Megabits per second or Mbps). The key takeaway is that many respondents seem confused about their home internet service package.

Our survey supports the notion that the telecom industry has become mired in a sea of sameness coupled with mediocre internet provider satisfaction levels. The provider with the highest level of reported customer satisfaction, Cox Communications, reached only 66% (Top 2 Box) while CenturyLink came in the lowest at 48% (Top 2 Box). These findings indicate that with so many unsatisfied customers, there is a large opportunity for growth possible for businesses in the telecom category.

This final blog post in our series provides recommendations for the three most critical dimensions of your telecom marketing strategy—your product, brand and price-- based on data points from the survey and examples of B2C companies that have utilized these key areas successfully to differentiate their business.

First Dimension: Product

Your internet service product is the first part of your telecom marketing strategy to tackle. Fortunately, product is a particularly ripe area for disruption in telecom marketing given the high levels of the respondents’ confusion over their perceived internet service speed and download speeds. Their confusion makes sense, due to the frequent use of vague superlatives like “super,” “turbo” and “ultra” that telecom providers often use to describe their service speed tiers.

Download Speed Confusion

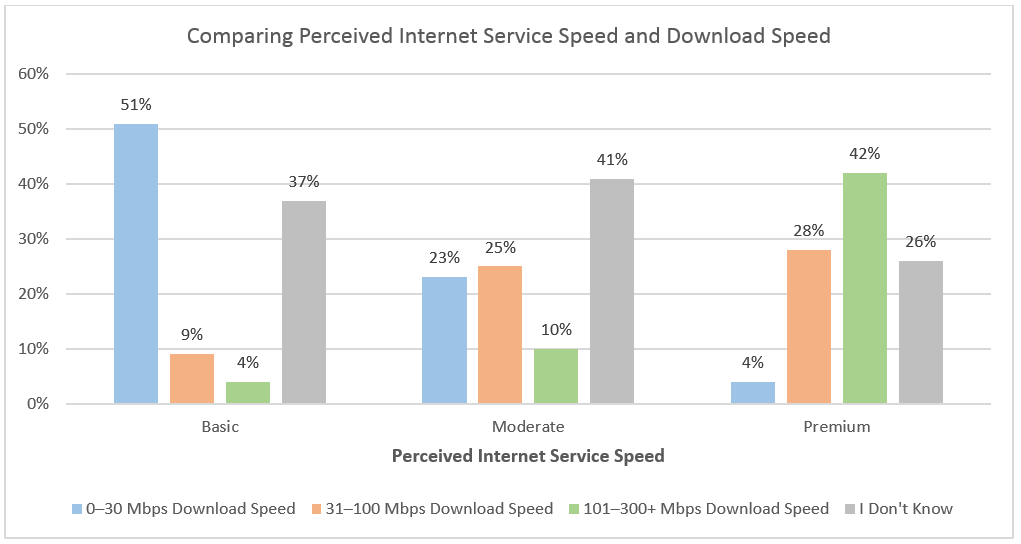

Twelve percent of survey respondents described their home internet service as “basic,” but when asked about their download speeds, only 51% of this same group reported having actual basic speeds between zero and 30 Mbps. Over a third (37%) didn’t know how to classify their download speeds at all.

This confusion also extended to faster speed tiers. Respondents who perceived their home internet service speed as “moderate” largely didn’t know how to classify their download speeds with nearly the same percentage reporting their speeds as 30 Mbps or slower (23%) than actual moderate speeds of 30–100 Mbps (25%).

This confusion has likely led to customers selecting the wrong home internet solution for their needs. The purchasing behavior for survey respondents may have been driven by price, rather than the benefits of faster service.

Success Story: Rocket Mortgage—Home Mortgage Approval in Minutes

In many ways, the home mortgage industry resembles the telecom industry, as there is little customer-perceived differentiation between mortgage lender brands and their offerings.

Quicken Loans® recently introduced a new digital mortgage product, Rocket Mortgage, aimed at first-time home buyers. The online smartphone app and web product dramatically reduced the length of the application process down to just a few minutes for approval to buy or refinance a home. Quicken Loans® states that their product cuts about 12 days off the loan closing process compared to the industry average.

“The product has been a success in so many ways, including its strong appeal to first-time homebuyers and ability to remove the intimidating and cumbersome aspects of the traditional mortgage process,” said Jay Farner, CEO of Quicken Loans®.

Product Dimension Takeaways

The key to your product differentiation marketing strategy is to identify a solution based on customer need and preferences. Don’t be afraid to disrupt the category dynamic around delivering internet service products that offer new options for product naming, method of obtaining products, benefits and more.

- Consider going beyond labeling service products with generic “download speed-based” terms, such as turbo, ultra or super

- Customers are more likely to consider a product if they understand how it directly benefits them—think about how a product fits into the target customer’s daily lifestyle

- Differentiated products can better educate customers about their service level and manage expectations earlier in their subscription period by providing a clear, digestible and concise description of exactly what the customer is getting with each package

Second Dimension: Brand

Branding may be the most critical part of your telecom marketing strategy. Setting your brand apart is particularly challenging within the telecom industry given the relative similarity in product and price offerings between national and regional telecom companies. Building a successful brand is about going beyond meeting basic expectations in the heavily populated telecom market to offer a compelling brand story that resonates with audiences for years to come. Becoming a beloved brand takes time and consistent messaging, but the end result is worth the hard work and diligent planning.

Telecom Category Critics

Despite over half (57%) of the survey respondents feeling highly satisfied with their home internet provider (Top 2 Box), just over a fifth (21%) of respondents were highly likely to consider switching home internet providers in the next 12 months (Top 2 Box).

When measuring consumer advocacy of their providers, over half (54%) were critical of their providers and prone to actively generate negative word of mouth. Only around a quarter (27%)of survey respondents would be highly likely to advocate for their current home internet provider by providing positive word of mouth.

This points to one of the fundamental issues within the telecom industry—customer loyalty is low even among those that are generally satisfied with their home internet service as shown by their willingness to consider switching.

Success Story: Southwest Airlines—Delivering an Authentic Customer-Focused Brand

In 2018, the notion of flying is enough to stress even the most seasoned frequent flyer, due to long security lines, potential bag fees, cancellation fees, cramped seats and overbooked flights. It can often feel like the major airlines don’t care about creating a brand experience that benefits their customers.

Fortunately, there is one airline today that puts people at the heart of its business. In the early 1970s, Southwest Airlines disrupted the aviation industry by democratizing air travel for all through making fares affordable and transparent. The airline continues this emphasis today by imparting a customer-friendly approach to all aspects of its brand. Southwest now flies more passengers within the US than any other airline.

“At every level of its brand, Southwest outpaces the competition, distinguishing itself as more transparent and human,” said Claude Salzberger, president of New York City-based brand agency MBLM.

Southwest Airlines has cultivated a brand built on providing a better flying experience that feels focused on customer experience through the brand’s consistent marketing campaigns promoting their commitment to transparency. As a result of Southwest’s focus on delivering its brand mission, the company is a profitable, growing operation that people actively seek out in a maligned category.

Southwest succeeds because they created a relatable brand story and purpose around a service product that offers clear audience benefits (e.g., lower fares, no checked bag fees) that they have consistently stuck with.

Brand Dimension Takeaways

The key to the brand dimension of your marketing strategy is to build your company’s purpose around a story that resonates with your target audience segment(s) by offering a clear benefit. Start by asking how your service offering allows you to own a category differentiator.

- Consider how your service product offering is different from local competitors

- Is your brand ideal for large families or heavy streamers? Define which audience segments could benefit the most from your brand today

- A brand audit can uncover how your brand is perceived by both existing subscribers and non-subscribers. This can provide possible leverage points crucial to overhauling your brand story

Third Dimension: Price

Any attempt to address your internet service product and telecom brand should include pricing as part of your marketing strategy. Determining the right price to attract new customers while retaining existing ones is one of the most difficult strategies to execute. However, by utilizing the first two dimensions of product and branding, your business can justify more optimized pricing than the competition.

Consistent Internet Role Across Income Groups

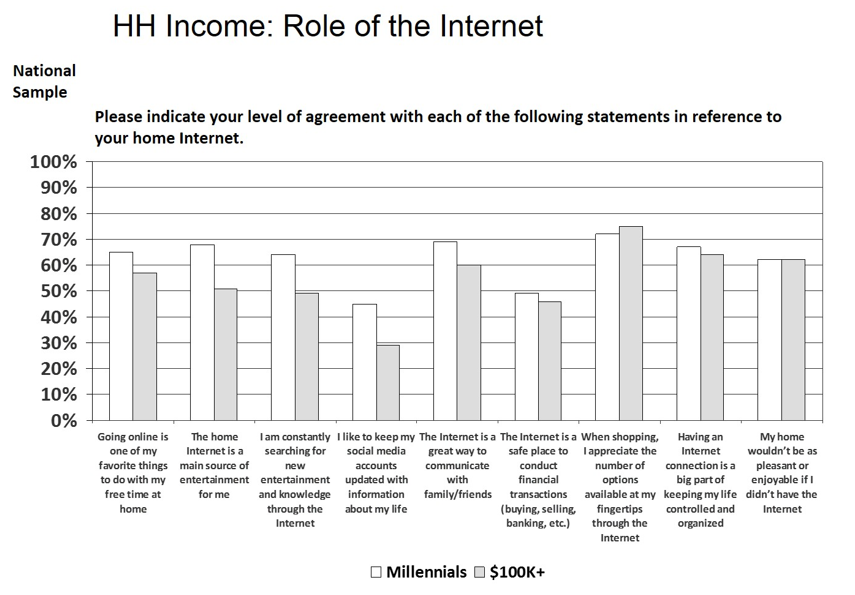

When lower income households (annual HHI under $50,000) and higher income households (annual HHI over $100,000) were asked about the role the internet plays in their lives, they were most likely to indicate strong agreement (69% of them did so) with the statement “when shopping, I appreciate the number of options available at my fingertips through the internet.” In many ways, the internet is viewed as a research engine for pricing, product offerings and more.

The survey begins to dispel the notion that lower income households behave differently than higher income ones. Low income household customers do not equate to low price customers, particularly among Millennial respondents who may someday move into the higher income household group. As seen in the chart below, in all but one category Millennials resemble the beliefs of higher income households.

Pricing relates to the degree of value customers put on their home internet service. While value is subjective, it’s generally focused on a balance between cost and quality, and comes down to whether customers feel like they can accomplish their most frequent tasks on a consistent basis without issues.

Success Story: Warby Parker—Crafting Designer Eyewear at a Disruptive Price

The prescription eyewear industry is a classic example of an industry lacking competition and customers paying the price as a result. Then graduate students, the founders of Warby Parker founded the company in 2010 with the desire to offer designer eyewear at a revolutionary low price. The result is a disruptive business model valued at $1.75 billion (as of March 2018) having raised nearly $300 million in private investments.

With a price point that starts at just $95 for entry-level single prescription lens glasses or sunglasses, Warby Parker makes the brand’s designer-inspired frames affordable. Customers can even try on several different frames for free through the company’s in-home trial offer.

“[Warby Parker] discovered a problem, and they found a solution that wasn't the typical solution—going beyond just being a low-price competitor and offering a focus on style and customer service,” said Wendy Liebmann of New York City-based consultant firm WSL Strategic Retail.

It is very easy to spend more than $95 at Warby Parker for bifocal lenses and higher quality lens frames, but the brand markets their lower price point as part of their value brand story. Of course, this story is only possible due to the fact that Warby Parker manufactures and distributes their own frames online. The brand stays fresh and relevant by constantly introducing new designer collaborations and seasonal collections.

With limited marketing spend, Warby Parker focuses on delivering a fantastic customer service experience worth sharing with your friends and family. Like Southwest Airlines, Warby Parker delivers a customer service-focused brand experience. This makes it easy to feel good about the price in comparison to other eyewear brands that do not have such an intimate relationship from trial to purchase.

Price Dimension Takeaways

The key to your price dimension marketing strategy is to understand how to talk about pricing with your current and potential customers that emphasizes value. Once customers understand the value of your internet brand and service products they can better assess if it is a good fit or not.

- Consider repackaging your service product solution and price point to lend itself to better value perception in the category based on targeted internet activities

- Utilize existing sales metrics to determine the optimal pricing per market

- Your pricing strategy should be motivated by developing the best balance of quality service in terms of both consistent internet service and customer service

Telecom Survey Lessons

In the first part of our blog series, we looked at the key service criteria for subscribers of the top internet providers compared to alternative internet providers. What we found was that the subscribers to the top internet providers look for faster download speeds and more responsive customer service while those who have service with an alternative internet provider (consisting largely of smaller, regional providers) seek reliability and a seamless internet experience.

With the understanding that speed and reliability are the key service criteria for satisfaction, we spent the second part of our blog series discussing a continuum of streaming behaviors which yielded three distinct streaming segments: “heavy,” “moderate” and “casual streamers.” This segmentation provided a richer way to understand and target your potential and existing subscribers and emphasized the need for telecom providers to offer product solutions targeting specific activities and habits.

When thinking about your customers through the lens of behavioral segmentation you can start to design a marketing solution that differentiates your business and includes the three key dimensions of product, brand and price in a category currently defined as a sea of sameness. It is important to tackle all three dimensions to maintain consistency for existing customers while maximizing your relevance to a target audience of new customers.

If you need help getting started on how best to optimize your telecom company’s marketing strategy, please contact us.